Pension-Gate

By: Mary Brunson | October 19, 2011

Plan sponsors and trustees of pooled investments such as retirement plans, foundations and endowments frequently implement an active investment strategy, relying on investment consultants and advisors to recommend fund managers whom they anticipate will deliver above benchmark returns. Plan sponsors and trustees of pooled investments such as retirement plans, foundations and endowments frequently implement an active investment strategy, relying on investment consultants and advisors to recommend fund managers whom they anticipate will deliver above benchmark returns.

Consider for a moment the inherent conflict that exists for such consultants who likely find it difficult to advise their clients to abandon what David Swensen terms “the loser’s game" of active management and recommend instead a purely passive portfolio. Following this idea to its logical conclusion, these consultants may surely know that their presumed necessity evaporates when plan sponsors embrace passive investing. As Upton Sinclair so keenly observed, “It is difficult to get a man to understand something when his salary depends upon his not understanding it.”

Support for Swensen’s observation is found among analysis of state pension plans. An investigative journalist for St. Petersburg Times approached Index Funds Advisors (IFA) and a handful of other investment experts to collect some data regarding the risks and returns of Florida’s State Pension Plan, comparing then to various index portfolio strategies.

The results of the research were revealed in a July 31, 2011 article titled, “Easy investments beat state’s expert pension planners.” The article concluded that a simple index portfolio would have outperformed the state’s pension plan performance over the last ten years. The professionally managed SBA [State Board of Administration] performed worse—by more than a percentage point—than seven index-fund portfolios for the decade ending Dec. 31, 2010. “On average, a $100 investment in an index portfolio grew to $184, while Florida’s pension delivered just $157,” the article stated.

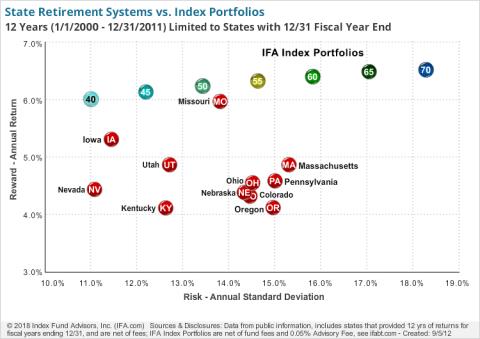

Florida’s $124 billion pension performance was far from alone in its lackluster performance when compared to simple indexing strategies. IFA has attempted to analyze the employee retirement systems for all 50 states. Data on more than 40 state pension plans have been received to date, yielding similar results with varying degrees of underperformance relative to the index portfolios.

The four accompanying charts depict the annual risk and return of various state pension plans, net of fees, compared to seven passively managed index portfolios comprised of a blend of diversified asset allocations. A best effort was made to estimate fees in states that report returns before fees are deducted. States were analyzed for both 10 or 11-year periods and 23 or 24-year periods and were charted based on either a June 30th or December 31st year-end date. The data show only one state succeeded to outperform, albeit negligibly, relative to the index portfolios.

Click here to view the full chart » Click here to view the full chart »

Click here to view the full chart » Click here to view the full chart »

Click here to view the full chart » Click here to view the full chart »

Click here to view the full chart »

Pension plans access the most highly reputed money managers and investment consultants, but have failed to outperform risk-appropriate benchmark index portfolios. This analysis leads an investor to inevitably conclude that the widely implemented, but costly process of relying on consultants to recommend the hiring and firing of investment managers offers a negative payout relative to a risk-appropriate set of index benchmarks. This sort of detailed analysis is likely the impetus for highly regarded industry legends such as 1990 Nobel Prize winner Merton Miller to assert as follows:

| “I have often said, and I know this will get some of your readers mad, that any pension fund manager who doesn't have the vast majority - and I mean 70% or 80% of his or her portfolio - in passive investments is guilty of malfeasance, nonfeasance or some other kind of bad feasance! There's just no sense for most of them to have anything but a passive investment policy.”

- Merton Miller, Nobel Laureate in Economics, 1990, An Interview with Merton Miller, Investment Gurus, by Peter Tanous, February 1997

|

There is little doubt as to what the proper investment strategy should be for pension plans, but what of the individual investor with no such access to a pension for his or her retirement? IFA offers tools to help pave the way towards your retirement goals. One of these invaluable instruments is our Monte Carlo Simulation. By inputting your age and time horizon, initial wealth, periods of savings and withdrawals, investment risk level, and the option to Glide Path, you can ascertain, based on the simulation of 10,000 portfolio outcomes, the statistical probabilities of portfolio survival at various ages of your retirement. Our Monte Carlo Simulation is just one of the many tools IFA offers to match you with your portfolio.

New to IFAtube.com Mark Hebner discusses IFA’s new Retirement Analyzer

click here to watch the video.

It is IFA’s privilege to share this information with you. Each of our investment professionals welcomes the opportunity to assist you in your quest for risk-appropriate, low-cost returns. To learn more, please call 888-643-3133 or visit ifa.com.

|

About Us

Index Funds Advisors (IFA) is a fee-only independent financial advisor that provides wealth management by utilizing risk-appropriate, returns-optimized, globally diversified and tax-managed portfolios of index funds. (Learn more)

Index Funds Advisors, Inc.

19200 Von Karman Ave.,

Suite 150

Irvine, CA 92612

Call Toll Free: 888-643-3133 Local Phone: 949-502-0050 Fax: 949-502-0048

|

© Index Funds Advisors 2011

|