Risk Capacity

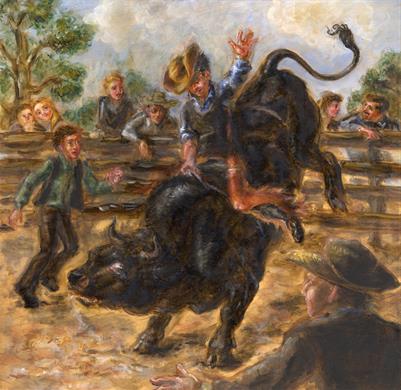

Risk CapacityEnvision the market as a wild bull, bucking up and down, rearing and spinning. Investors are like bull riders, trying to hang on as the bull kicks and twists, making for a tumultuous ride. Matching the right portfolio to an individual’s ability to handle risk is akin to finding the right bull that each investor can ride through all the ups and downs of the market.

Each investor has a unique risk capacity, one which can be identified and quantified in a risk capacity score which is a measure of how much risk an individual can manage. This score is based on five specific dimensions of risk capacity: 1) time horizon and liquidity needs; 2) attitude toward risk; 3) net worth; 4) income and savings rate; and 5) investment knowledge.

Risk capacity can be regarded as a measurement of an investor’s ability to earn stock market returns. Calculating risk capacity is the first step to deciding which portfolio will generate optimal returns for each investor. A risk capacity score determines the proper risk exposure for an investor’s portfolio.

Many investors face the improper measurement of their risk capacity. Each of the five dimensions has to be carefully examined and quantified. Some dimensions carry more weight in the final score. The survey must be carefully designed, and investors must be accurate when answering the questions.

An easy and efficient way to determine an investor’s risk capacity is to complete a questionnaire or a survey that evaluates and quantifies each of the five dimensions of risk capacity. Several such surveys can be found at ifarcs.com,which quantify risk capacity using numerical values from 1 to 100. These values correspond to various index portfolios created with the indexes referenced in Step 9.

Once an individual has completed a survey, an overall score is provided, which reflects that investor’s capacity to take risk. An asset allocation of stocks and bonds with a risk exposure that properly matches the individual’s risk capacity is also recommended.

Higher scores signify a higher capacity for risk, a longer time horizon and an ability to withstand market volatility. Investors with higher scores are generally recommended to hold portfolios with a larger allocation of global stocks. In contrast, lower scores signify a lower risk capacity and a higher need for liquidity. Investors with lower scores are steered toward more conservative portfolios that hold a higher proportion of short-term investments such as fixed income.

Time

TimeArchimedes is often referenced as saying, “Give me a lever long enough and a place to stand, and I can move the earth.” In the world of investing, that lever is time. The longer investors can hold onto their portfolios, the greater their risk capacity. Will an investor need 20% of the value of his investment portfolio in two years, five years, seven years, 10 years, or longer? Usually, the closer a person is to retirement, the shorter his or her investment horizon becomes. Risk-calibrated index portfolios carry recommended holding periods that range from four to 15 years. The longer an investor holds onto a risky investment, the greater the chance of obtaining its average historical return and the greater the ability to reduce the uncertainty of these returns through time diversification.

Sample Risk Capacity Survey Question:

Please estimate when you will need to withdraw 20% of your current portfolio value, such as a need for a house down payment or some other major financial need?

- Less than 2 years

- From 2 to 5 years

- From 5 to 10 years

- From 10 to 15 years

- More than 15 years

Attitude

AttitudeThis risk capacity dimension assesses aversion or attraction to risk, providing an estimation of an investor’s willingness or ability to experience an investment loss. The last 90 years have shown that stock market investing can be a wild ride, with a lot of volatility and uncertainty. Investors who hold riskier investments can expect higher returns, but with greater volatility. Some people take less risk than they’re actually capable of taking, preferring the tranquility of Ferdinand the Bull over the untamed violence of Crossfire Hurricane to carry them on their ride through the market.

Sample Risk Capacity Survey Question:

What is the worst 12-month percentage loss you would tolerate for your long-term investments, beyond which you would be inclined to sell some or all of your investment?

- A loss of 50%

- A loss of 40%

- A loss of 30%

- A loss of 20%

- A loss of 10%

Worth

WorthWhat is the current value of an investor’s long-term investments or golden nest egg? Net worth is the value of an investor’s assets minus liabilities, or in other words, what is owned minus what is owed. Investors have a positive net worth when they own more than they owe. An individual’s total net worth can provide a cushion against short-term stock market volatility and the uncertainty of future cash needs. Because life itself is a random walk, investors can never be completely certain of what their cash needs will look like tomorrow. The more assets in reserve, the greater the capacity for risk.

Sample Risk Capacity Survey Question:

What is the current value of your long-term investments? Please include your taxable accounts, retirement savings plan with your employer and your individual retirement accounts (IRAs).

- Less than $25,000

- $25,000 to $50,000

- $50,000 to $100,000

- $100,000 to $250,000

- $250,000 or more

Income

IncomeThe Income and Savings Rate dimension estimates excess income and ability to add to savings. A high score indicates that a large percentage of income is discretionary and is available for investing. A low score indicates that all or almost all income is being used for ordinary expenses and not being added to annual investments. A higher income also bolsters the ability to respond to emergencies without cashing out portfolio funds. Having to take money out of your portfolio after it has declined creates irreparable harm to your long-term returns. Having a solid income will minimize the chance you will need to dip into your retirement account. That is why this dimension is an important consideration when assessing risk capacity.

Sample Risk Capacity Survey Question:

What is your total annual income?

- Less than $50,000

- $50,000 to $100,000

- $100,000 to $150,000

- $150,000 to $250,000

- $250,000 or more

Knowledge

KnowledgeAn individual who understands several key concepts that impact investing, such as the failure of active management, the Random Walk Theory, the Efficient Market Hypothesis, the Five-Factor Model, and Modern Portfolio Theory has a greater capacity for risk than someone without this understanding.

Sample Risk Capacity Survey Question:

The performance of stock pickers must be examined on an adjusted basis. When comparing the returns of a stock picker’s portfolio to an appropriate index, which factors must be considered before determining if the stock picker has beaten the index?

- Proper accounting of returns, including cash flows in and out of the account

- Exposure to market, size, and value risk of both portfolios

- A statistical analysis of the difference in returns with a measure of the significance of the difference, such as the t-stat

- Standard deviations or volatility measurements

- All of the above

Most Aggressive

Individuals who score 100 on a risk capacity survey (scaled from 1-100) likely possess nerves-of-steel with a general proclivity toward high-risk activities tantamount to skydiving, NASCAR racing, surfing typhoon waves or other extreme sports. This type of investor has a strong gut for withstanding extreme volatility in exchange for maximum portfolio growth potential; a substantial amount of investable capital; a secure income stream and in-depth knowledge about how the stock market works. These investors may be relatively young, with the capacity to wait at least 15 years before withdrawing as much as 20% of their investments. Over the course of their investment’s lifetime, these individuals are able to expose their capital to high levels of risk and commit to staying the course during considerable market volatility, such as the 57% decline that occurred over the one-year, four-month period from November 2007 to February 2009, and the wild upturn from March 2009 through December 2017 which produced a 313% total return. Along with their ability to take on high risk, they are very disciplined in buying, holding and rebalancing asset classes without jumping in and out of the market. They are willing to tie themselves to the mast and ignore the media and doomsayers who sing their siren songs with intensity. At the end of Step 11, you can see Index Portfolio 100. Very few investors have a risk capacity of 100. Please take the Risk Capacity Survey before investing any capital at this level of risk.

Moderately Aggressive

Younger professionals with new careers or young families beginning to save for their children’s college would likely score near the risk capacity 75. These individuals generally possess an understanding about the sources of stock market returns and are willing to take moderately aggressive risks to capture the returns associated with increased volatility. These investors understand the long-term benefits of the multi-factor model of investing and are aware that they are entitled to earn returns commensurate with the risks they take. They are also prone to some thrill seeking, demonstrating their penchant for risk and adventure. Although they have a higher risk capacity than others, they require about 25% fixed income to soften their portfolio’s volatility. They may need some access to a small percentage of liquid assets to acquire a house or car, or to accommodate the unforeseen events that unfold in life. This risk capacity is suitable for investors who have at least 13 years before needing approximately 20% of their investments and are willing to accept a higher degree of volatility in order to achieve higher portfolio growth potential. Risk exposures associated with this level of risk capacity lost about 44% of their value over a one-year, four-month period in 2007 to 2009, and from March 2009 through December 2017, they saw a 201% increase, with an annual expected return of 10.81% (based on the last 50 years). At the end of Step 11, you can see the risk and return data for Index Portfolio 75.

Moderate

Individuals in their late-40s to mid-50s with growing families and careers in full swing would likely score close to a 50 on a risk capacity survey. These investors may have children graduating from high school or college with younger children still at home. Some may be eyeing retirement, making plans for future activities, hobbies or travel. Such individuals would have about eight years before they would need to withdraw approximately 20% or more of their investments and would be willing to accept a moderate degree of volatility in order to achieve moderate portfolio growth. This capacity for risk is appropriate for those who can stomach a moderate amount of risk in their portfolios and have the emotional fortitude to close their eyes to the market’s highs and lows, choosing instead to focus on the long-term historical return, which is the expected return. The risk exposure that would be appropriate for this capacity would have lost about 30% during the worst one-year, four-month period from November 2007 to February 2009, and gained 116% from March 2009 through December 2017, but has an expected return of 9.15% per year (based on the last 50 years). Such investors would need or want to invest in stock market equities with an eye toward fueling long-term growth, but would remain mindful of their need to dampen volatility given their window to retirement. At the end of Step 11, you can see the risk and return data for Index Portfolio 50.

Conservative

Investors in their mid-70s and enjoying their golden years would likely score close to a 25 on a risk capacity survey. They may be engaged in the lives of their grandchildren and regularly enjoying hobbies. A risk capacity level of 25 is suitable for these investors who have at least five years before needing approximately 20% of their investments and are willing to accept a conservative degree of risk for incremental appreciation with emphasis on capital preservation. At this stage in life, these individuals are less likely willing and able to take on risk. These individuals would shun stock market risk in exchange for a smoother ride through the markets during their later years of retirement. A portfolio of risk that would be appropriate for this conservative investor lost about 14% of its value during the worst period of decline in November 2007 through February 2009, and it delivered a 53% return from March 2009 to December 2017, with an expected annual return of 7.25% (based on the last 50 years). At the end of Step 11, the risk and return data for Index Portfolio 25 is provided.

When investors actively participate in the investment process by conducting the self-examination required to establish a risk capacity score, they better position themselves to weather appropriate levels of market volatility, thereby enhancing their ability to experience a high degree of investment success.

See Appendix A (https://www.ifa.com/disclosures/)